When to Raise Capital for Your Startup

When to Raise Capital for Your Startup

This is the second in an occasional series of blogs for fledgling entrepreneurs

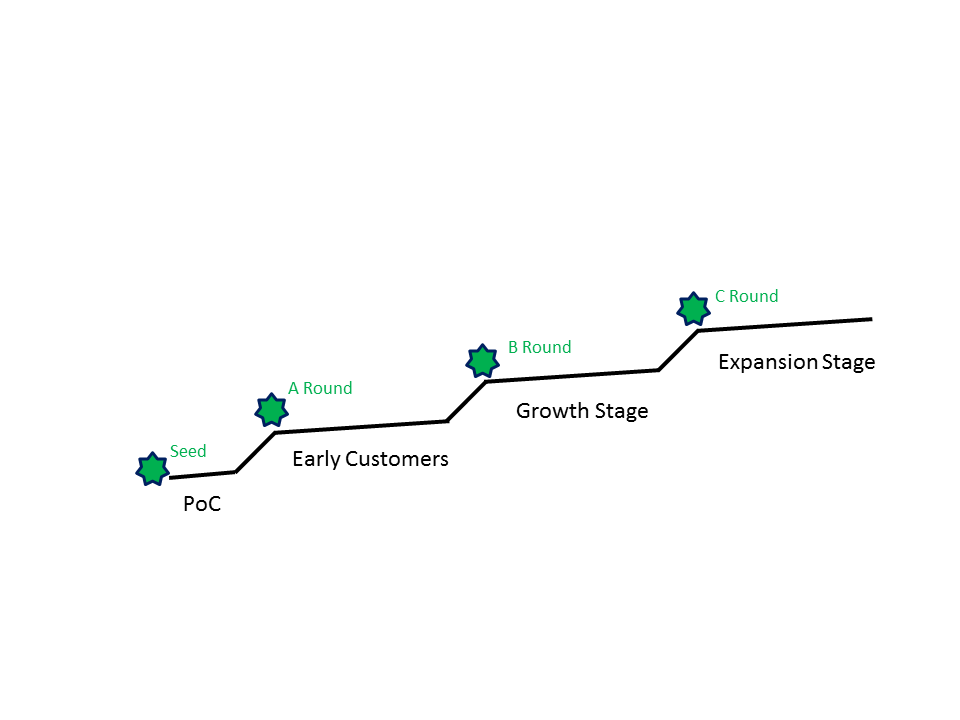

In my last entrepreneurial series blog I explained how to raise capital for your new company. In this blog I’d like to share my thoughts on when to raise capital. Every startup goes through several distinct stages of development. Generally speaking, at every stage you want to raise just enough money to get you to the next phase. Of course the amount of money you need, how you raise it and the exact timing will vary widely from company to company.

While every startup is different, most tech companies pursue seed funding to demonstrate proof of concept, and seek subsequent rounds of financing to launch the product, scale the company and ultimately set the stage for an acquisition or IPO.

Proof of Concept Funding (Seed Funding)

Let’s start at the beginning and say you’ve got a great idea for a new product. You’ve put together a small team and you’re getting ready to start your company. For most startups, the first step is to raise enough money to demonstrate that you have a viable product, capable executive team and workable business plan. The idea with successive rounds of funding is to knock down the risk factors, such as “Will the product work?” “Can these guys build it?” or “Will anyone buy it if they can build it?” Your seed funding should be sufficient to give you enough time to get past at least one of the big risk factors.

In the case of Wasabi, Jeff Flowers came to me several years ago with an idea for a new storage platform that would be faster and cheaper than anything on the planet, but he needed a year to build it and see if he could get it to work. So we had to raise sufficient funds to get us through a full year of development. There’s no point in securing seed funding if you’re going to run out of money before you are able to prove out your concept and knock down that first risk factor.

Go-to-Market Funding (A Round)

Once you have a demonstrable product you’ll need to raise additional funds to commercialize it and bring it to market. You’ll need to secure enough money to build up your development team, get your product production-ready and ramp up your sales, marketing and support organizations. Having a working product (and maybe even some customer commitments) increases the value of your company, removes risks for investors and makes it easier for you to raise money. You’ll need to demonstrate that customers care about what you’re doing enough to buy it, use it and endorse it.

Growth Stage Funding (B Round)

Once you’ve launched the product and landed some early customers you’ll need to secure additional funding to scale the company. At this stage, companies typically ramp up operations and bring in senior managers like a VP of Engineering, CFO, and VP of Operations who have experience running large organizations. The timing of these hires is critical. You don’t want to get ahead of the curve and bring on a high-priced VP of Sales until you have a viable product to sell. The risk factor that you’re trying to knock down with your B round is to prove that your team can scale and grow a business.

Expansion Stage Funding (C Round and Beyond)

Once you’ve achieved some commercial success, you may need additional funding to get to cashflow breakeven. Most companies eventually need to make money and demonstrate sustainability. Frequently this means broadening your product portfolio, expanding geographically, and enforcing financial discipline. If all goes well, this round will fund the last stage in your company’s growth cycle before an IPO or acquisition. It’s not uncommon, however, for this process to take several rounds of funding. If things are on a good trajectory, the money will probably be there for a D and E round, etc. Some companies take on mezzanine rounds or bridge loans to reach the finish line.

Raise Money at the Beginning of Each Growth Cycle Stage

Investors value a company differently at each round. In a seed or A round they are likely to be focusing on the viability of the product: “If they build it, will anybody care?” “Is there a market for this product?” If they get past that concern, they are also going to ask themselves, “Is this team capable of building the product and proving that it can be sold?” If you successfully build the product and find a few early customers, the B round will be about competition and the viability of the business: “Will this product be easy enough to sell that we can eventually build a big company and make a profit?” Once you have proven that you can sell and deliver the product, generally the next stage is expanding the business to grow value. That’s generally the reason you raise a C round and beyond. As your company moves from proof of concept, to early customers, to growth stage, you’ll continue to build value, clear investor hurdles and remove risks.

Timing is everything. It is important to raise money at the beginning of each growth cycle stage, after you’ve knocked down some major risk factors and cleared a set of investment hurdles. The value of your company is not going to rise in a straight line. It will take a stepwise uptick in value after each major proof point. By getting money at the right time, and securing the optimal funds to get you through the next proof point, you will always be selling stock at the optimum times and minimizing the dilution to the founders and earlier investors.

the bucket

This is the second in an occasional series of blogs for fledgling entrepreneurs

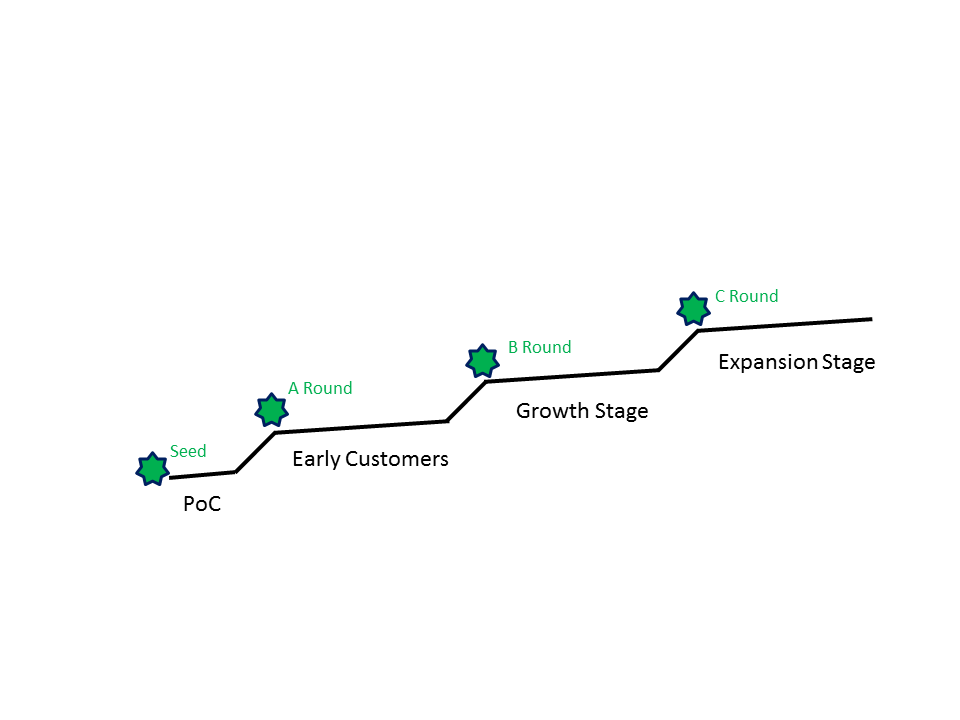

In my last entrepreneurial series blog I explained how to raise capital for your new company. In this blog I’d like to share my thoughts on when to raise capital. Every startup goes through several distinct stages of development. Generally speaking, at every stage you want to raise just enough money to get you to the next phase. Of course the amount of money you need, how you raise it and the exact timing will vary widely from company to company.

While every startup is different, most tech companies pursue seed funding to demonstrate proof of concept, and seek subsequent rounds of financing to launch the product, scale the company and ultimately set the stage for an acquisition or IPO.

Proof of Concept Funding (Seed Funding)

Let’s start at the beginning and say you’ve got a great idea for a new product. You’ve put together a small team and you’re getting ready to start your company. For most startups, the first step is to raise enough money to demonstrate that you have a viable product, capable executive team and workable business plan. The idea with successive rounds of funding is to knock down the risk factors, such as “Will the product work?” “Can these guys build it?” or “Will anyone buy it if they can build it?” Your seed funding should be sufficient to give you enough time to get past at least one of the big risk factors.

In the case of Wasabi, Jeff Flowers came to me several years ago with an idea for a new storage platform that would be faster and cheaper than anything on the planet, but he needed a year to build it and see if he could get it to work. So we had to raise sufficient funds to get us through a full year of development. There’s no point in securing seed funding if you’re going to run out of money before you are able to prove out your concept and knock down that first risk factor.

Go-to-Market Funding (A Round)

Once you have a demonstrable product you’ll need to raise additional funds to commercialize it and bring it to market. You’ll need to secure enough money to build up your development team, get your product production-ready and ramp up your sales, marketing and support organizations. Having a working product (and maybe even some customer commitments) increases the value of your company, removes risks for investors and makes it easier for you to raise money. You’ll need to demonstrate that customers care about what you’re doing enough to buy it, use it and endorse it.

Growth Stage Funding (B Round)

Once you’ve launched the product and landed some early customers you’ll need to secure additional funding to scale the company. At this stage, companies typically ramp up operations and bring in senior managers like a VP of Engineering, CFO, and VP of Operations who have experience running large organizations. The timing of these hires is critical. You don’t want to get ahead of the curve and bring on a high-priced VP of Sales until you have a viable product to sell. The risk factor that you’re trying to knock down with your B round is to prove that your team can scale and grow a business.

Expansion Stage Funding (C Round and Beyond)

Once you’ve achieved some commercial success, you may need additional funding to get to cashflow breakeven. Most companies eventually need to make money and demonstrate sustainability. Frequently this means broadening your product portfolio, expanding geographically, and enforcing financial discipline. If all goes well, this round will fund the last stage in your company’s growth cycle before an IPO or acquisition. It’s not uncommon, however, for this process to take several rounds of funding. If things are on a good trajectory, the money will probably be there for a D and E round, etc. Some companies take on mezzanine rounds or bridge loans to reach the finish line.

Raise Money at the Beginning of Each Growth Cycle Stage

Investors value a company differently at each round. In a seed or A round they are likely to be focusing on the viability of the product: “If they build it, will anybody care?” “Is there a market for this product?” If they get past that concern, they are also going to ask themselves, “Is this team capable of building the product and proving that it can be sold?” If you successfully build the product and find a few early customers, the B round will be about competition and the viability of the business: “Will this product be easy enough to sell that we can eventually build a big company and make a profit?” Once you have proven that you can sell and deliver the product, generally the next stage is expanding the business to grow value. That’s generally the reason you raise a C round and beyond. As your company moves from proof of concept, to early customers, to growth stage, you’ll continue to build value, clear investor hurdles and remove risks.

Timing is everything. It is important to raise money at the beginning of each growth cycle stage, after you’ve knocked down some major risk factors and cleared a set of investment hurdles. The value of your company is not going to rise in a straight line. It will take a stepwise uptick in value after each major proof point. By getting money at the right time, and securing the optimal funds to get you through the next proof point, you will always be selling stock at the optimum times and minimizing the dilution to the founders and earlier investors.

featured articles

THE CHANNEL TECH PARTNERS

January 24, 2024

Announcing the Winners of our 2023 Partner Awards

Announcing the Winners of our 2023 Partner Awards

WASABI TECHNOLOGY

January 23, 2024

A Letter from the CEO: On Wasabi’s Acquisition of C...

A Letter from the CEO: On Wasabi’s Acquisition of ...

VIDEO SURVEILLANCE

January 25, 2024

Navigating the Future: The Evolution of Security In...

Navigating the Future: The Evolution of Security I...

DATA MANAGEMENT CASE STUDY

January 22, 2024

Australian MSP Office Solutions IT Migrates Service...

Australian MSP Office Solutions IT Migrates Servic...

COMPLIANCE CASE STUDY

January 17, 2024