MEDIA & ENTERTAINMENT

The Top 4 (Plus One) Takeaways from Wasabi’s M&E Cloud Storage Index Report

The Top 4 (Plus One) Takeaways from Wasabi’s M&E Cloud Storage Index Report

What we learned from our survey of 100+ M&E IT decision makers

When Wasabi published the Cloud Storage Index Report, a survey of 1,000 IT decision makers, it gave us new insights into how cloud storage was being utilized around the world. We saw their challenges, their strategies, and their pain points. Looking closer at the data we realized that while there were trends common to all respondents, some industries stood out with a unique set of problems and solutions.

Media & Entertainment was of particular interest to us. The industry has vowed to move toward adopting cloud technologies but (as is typical of M&E) has been slow to make sweeping changes. Still, what we did find out about M&E’s current cloud storage practices was illuminating. Here are four of the most important finds from our survey of over 100 M&E IT decision makers.

1. M&E’s recent cloud storage adoption

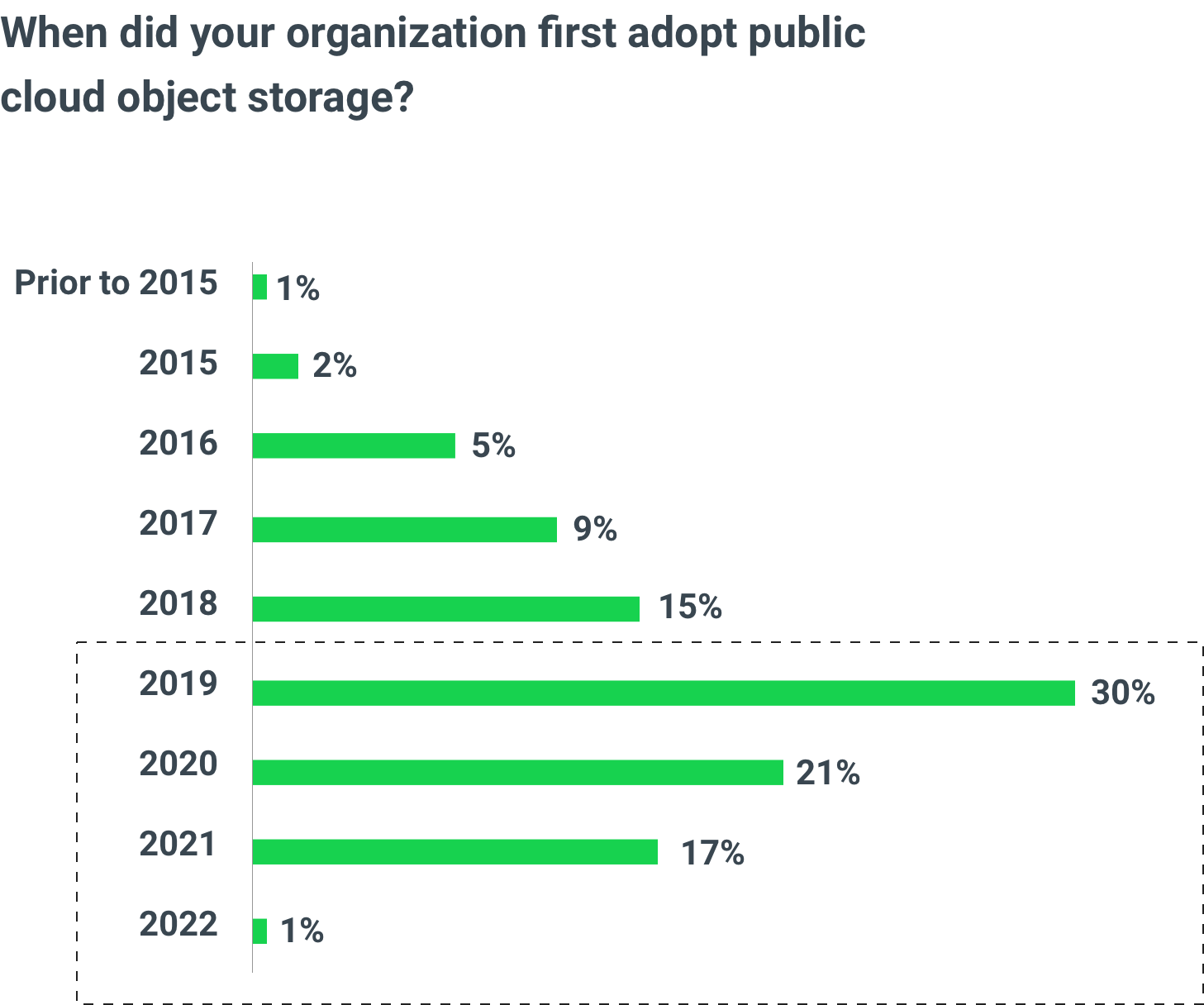

We knew M&E was new to the cloud overall, but just how new was a mystery. It turns out that 69% of M&E respondents started using public cloud object storage services since 2019. M&E is significantly ahead of (or should I say behind) the rest of the world in this regard.

Source: 2023 Wasabi Cloud IndexIn the same time span, 54% of respondents in the global survey adopted public cloud object storage technologies, making M&E among the most recent cloud storage adopters across market segments. While neither set indicates early adopter status, it’s enlightening if not a little predictable to see just how recently M&E has jumped on the cloud object storage bandwagon. We’ll see how this statistic plays a role in the results to come.

2. M&E favors balance of on-premises and cloud deployments

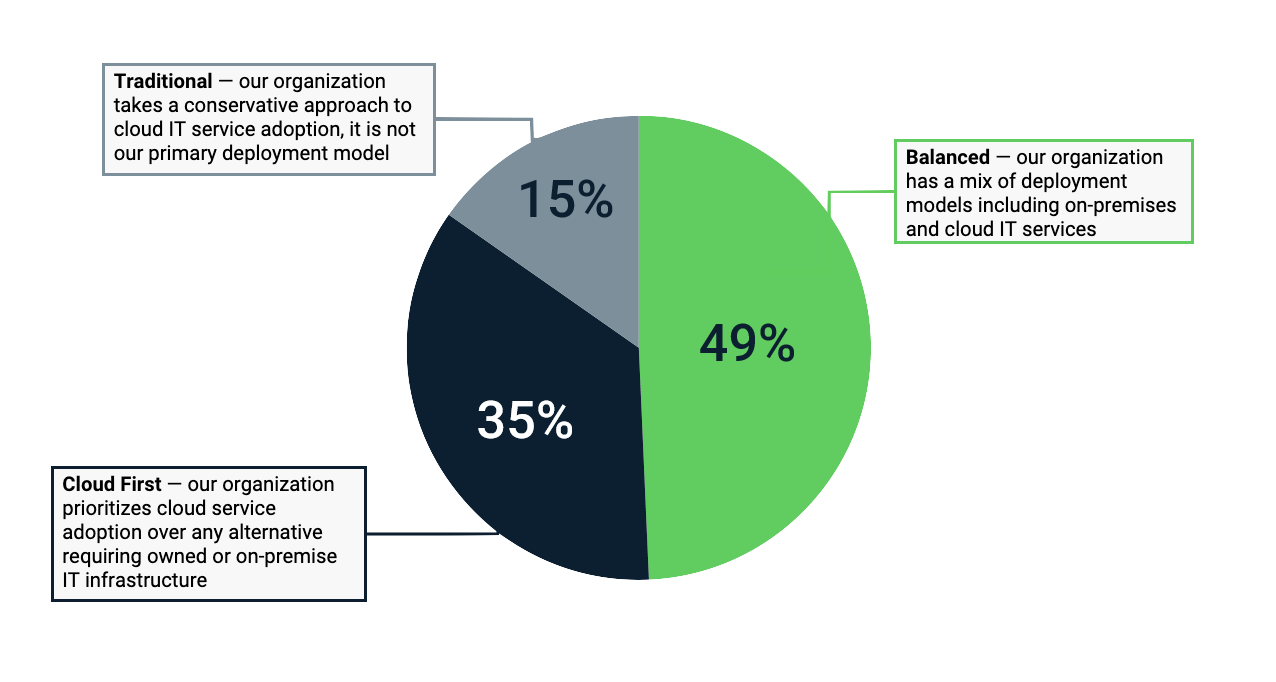

The M&E workflow is varied and complex. The path content takes from capture to your screen touches dozens of hands, applications, and storage devices. We saw this play out in the responses to a self-identifying question: How would you describe your organization’s approach to “cloud” IT services adoption, including storage?

M&E roundly favors the “balanced” approach, a mix of deployment models including on-premises and cloud IT services. The 49% of M&E respondents who chose this option was a bit higher than the global average of 41%, owing to the mix of technologies utilized in the M&E workflow. Also worth noting are the 15% of respondents who chose the traditional IT option, 3% below the global average of 18%. This indicates a strong bend toward hybrid models (a great first step for recent cloud adopters) and away from the on-premises solutions of old.

3. No sign of cloud slowdown

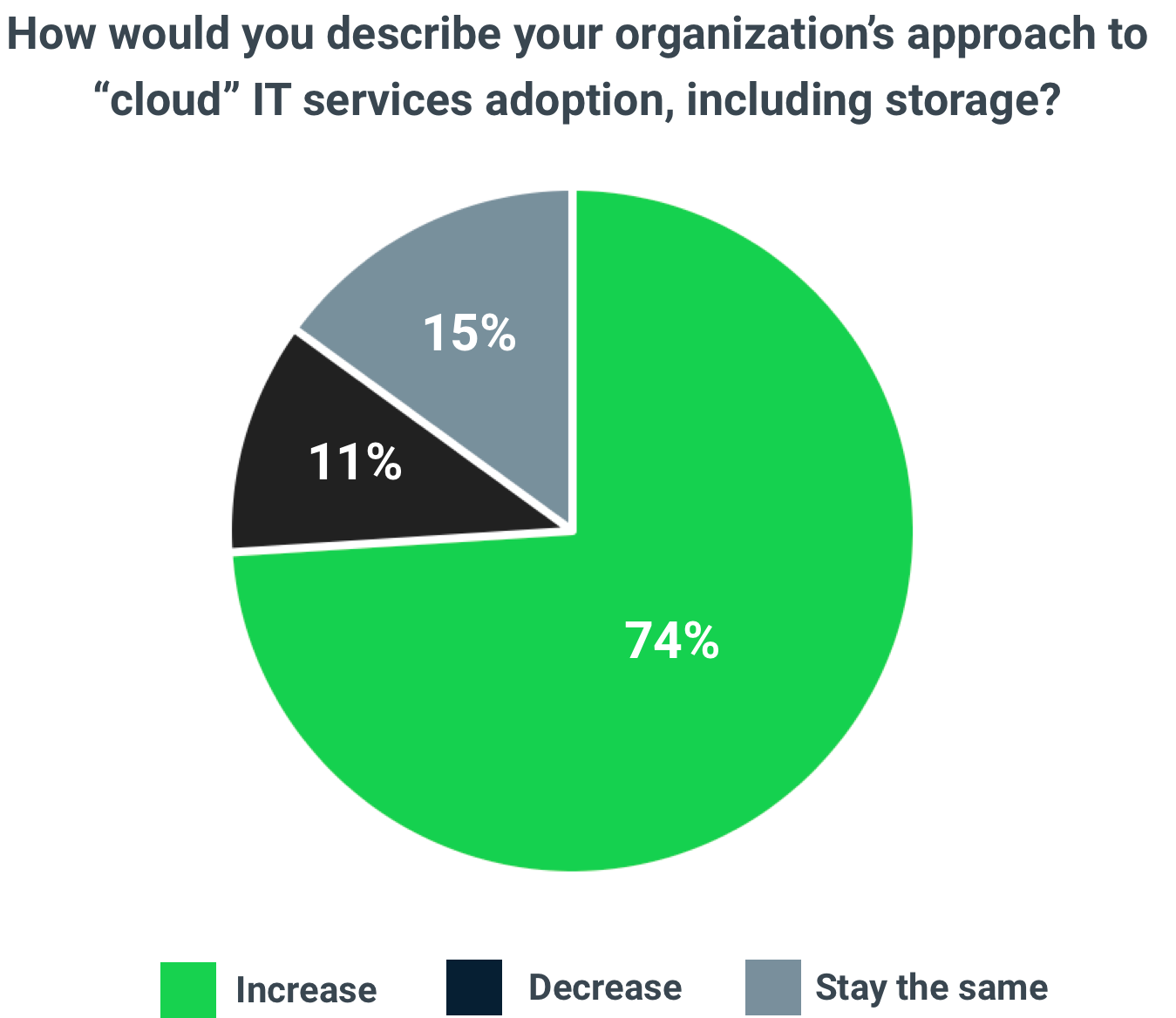

If the previous two responses had you thinking that cloud storage has no future in M&E, think again. A whopping 74% of M&E respondents anticipated their cloud storage use would increase in the next year. While that’s still a full 10% below the global rate, it’s still a resounding consensus and indicator of where the industry is putting its focus. The cloud excels at capacity at scale, and no industry has a need quite like media & entertainment where content is produced at a fast and furious clip at higher resolutions for more types of devices. That all spells bigger and bigger amounts of data for short and long–term storage. And the cloud is where that’s going to happen for M&E.

4. Budget issues abound

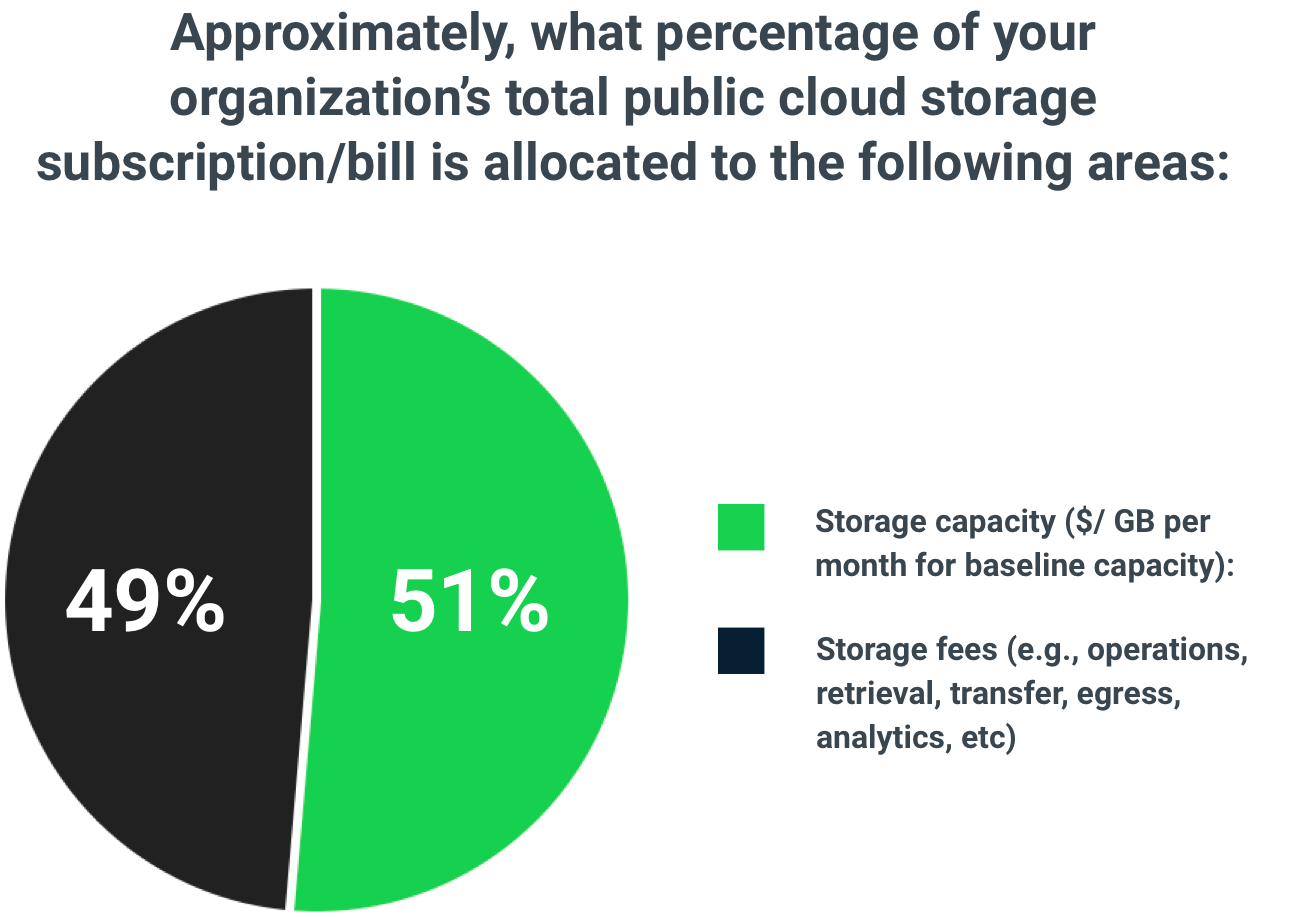

One trend that was consistent throughout the strata of survey respondents—across geographies, company sizes, and industries—was exceeding cloud storage budgets. M&E succumbed to this as well, with 54% saying their organization exceeded their cloud storage budget expectations. That alone would be cause for alarm—how could it be that so many companies are blowing their cloud storage budgets year after year?—but what made it click was the budget breakdowns they reported. An astounding 49% of the M&E storage budget was attributed to storage fees. I’ll repeat that: nearly half their bill was not for storage, the service they are ostensibly paying for, but ancillary charges they can’t predict and must abide by.

This is especially dangerous for M&E, whose large files are regularly being moved in and out of the cloud, tagged by media asset managers, and even edited from the cloud. All of these operations incur costs from hyperscale clouds and lead to the majority of organizations (not just in M&E) exceeding their planned cloud storage budgets.

From these survey results, it’s clear that M&E has some growing pains with their cloud storage deployments. They certainly have the right strategy in place with hybrid storage, but their budgets will need to be reigned in if they want to continue their planned expansion into the cloud. Choosing a cloud storage provider like Wasabi, which charges no additional fees for egress or API operations and making it simple and predictable month-to-month, is a good start.

See the full report

Read Wasabi's 2023 M&E Cloud Storage Index Report for more insights into how media & entertainment professionals are utilizing cloud storage today.

Read more

the bucket

When Wasabi published the Cloud Storage Index Report, a survey of 1,000 IT decision makers, it gave us new insights into how cloud storage was being utilized around the world. We saw their challenges, their strategies, and their pain points. Looking closer at the data we realized that while there were trends common to all respondents, some industries stood out with a unique set of problems and solutions.

Media & Entertainment was of particular interest to us. The industry has vowed to move toward adopting cloud technologies but (as is typical of M&E) has been slow to make sweeping changes. Still, what we did find out about M&E’s current cloud storage practices was illuminating. Here are four of the most important finds from our survey of over 100 M&E IT decision makers.

1. M&E’s recent cloud storage adoption

We knew M&E was new to the cloud overall, but just how new was a mystery. It turns out that 69% of M&E respondents started using public cloud object storage services since 2019. M&E is significantly ahead of (or should I say behind) the rest of the world in this regard.

Source: 2023 Wasabi Cloud IndexIn the same time span, 54% of respondents in the global survey adopted public cloud object storage technologies, making M&E among the most recent cloud storage adopters across market segments. While neither set indicates early adopter status, it’s enlightening if not a little predictable to see just how recently M&E has jumped on the cloud object storage bandwagon. We’ll see how this statistic plays a role in the results to come.

2. M&E favors balance of on-premises and cloud deployments

The M&E workflow is varied and complex. The path content takes from capture to your screen touches dozens of hands, applications, and storage devices. We saw this play out in the responses to a self-identifying question: How would you describe your organization’s approach to “cloud” IT services adoption, including storage?

M&E roundly favors the “balanced” approach, a mix of deployment models including on-premises and cloud IT services. The 49% of M&E respondents who chose this option was a bit higher than the global average of 41%, owing to the mix of technologies utilized in the M&E workflow. Also worth noting are the 15% of respondents who chose the traditional IT option, 3% below the global average of 18%. This indicates a strong bend toward hybrid models (a great first step for recent cloud adopters) and away from the on-premises solutions of old.

3. No sign of cloud slowdown

If the previous two responses had you thinking that cloud storage has no future in M&E, think again. A whopping 74% of M&E respondents anticipated their cloud storage use would increase in the next year. While that’s still a full 10% below the global rate, it’s still a resounding consensus and indicator of where the industry is putting its focus. The cloud excels at capacity at scale, and no industry has a need quite like media & entertainment where content is produced at a fast and furious clip at higher resolutions for more types of devices. That all spells bigger and bigger amounts of data for short and long–term storage. And the cloud is where that’s going to happen for M&E.

4. Budget issues abound

One trend that was consistent throughout the strata of survey respondents—across geographies, company sizes, and industries—was exceeding cloud storage budgets. M&E succumbed to this as well, with 54% saying their organization exceeded their cloud storage budget expectations. That alone would be cause for alarm—how could it be that so many companies are blowing their cloud storage budgets year after year?—but what made it click was the budget breakdowns they reported. An astounding 49% of the M&E storage budget was attributed to storage fees. I’ll repeat that: nearly half their bill was not for storage, the service they are ostensibly paying for, but ancillary charges they can’t predict and must abide by.

This is especially dangerous for M&E, whose large files are regularly being moved in and out of the cloud, tagged by media asset managers, and even edited from the cloud. All of these operations incur costs from hyperscale clouds and lead to the majority of organizations (not just in M&E) exceeding their planned cloud storage budgets.

From these survey results, it’s clear that M&E has some growing pains with their cloud storage deployments. They certainly have the right strategy in place with hybrid storage, but their budgets will need to be reigned in if they want to continue their planned expansion into the cloud. Choosing a cloud storage provider like Wasabi, which charges no additional fees for egress or API operations and making it simple and predictable month-to-month, is a good start.

See the full report

Read Wasabi's 2023 M&E Cloud Storage Index Report for more insights into how media & entertainment professionals are utilizing cloud storage today.

Read more

featured articles

THE CHANNEL TECH PARTNERS

January 24, 2024

Announcing the Winners of our 2023 Partner Awards

Announcing the Winners of our 2023 Partner Awards

WASABI TECHNOLOGY

January 23, 2024

A Letter from the CEO: On Wasabi’s Acquisition of C...

A Letter from the CEO: On Wasabi’s Acquisition of ...

VIDEO SURVEILLANCE

January 25, 2024

Navigating the Future: The Evolution of Security In...

Navigating the Future: The Evolution of Security I...

DATA MANAGEMENT CASE STUDY

January 22, 2024

Australian MSP Office Solutions IT Migrates Service...

Australian MSP Office Solutions IT Migrates Servic...

COMPLIANCE CASE STUDY

January 17, 2024