BUSINESS

Cloud Storage Economics: List Price Stagnation and Fee Inflation Challenge Traditional Expectations

Cloud Storage Economics: List Price Stagnation and Fee Inflation Challenge Traditional Expectations

On March 14, Google Cloud announced changes to its infrastructure services. These changes go into effect on October 1st, and several of the most significant pricing changes impact Google’s storage portfolio. GCP customers are undoubtedly aware of the change and have adjusted their cloud storage usage and budgets accordingly. You can see the complete list of pricing changes here.

Google’s pricing announcement is significant because it illustrates a larger shift in the cloud storage industry, characterized by list-price stagnation and fee inflation. Let’s explore these concepts in a little more detail:

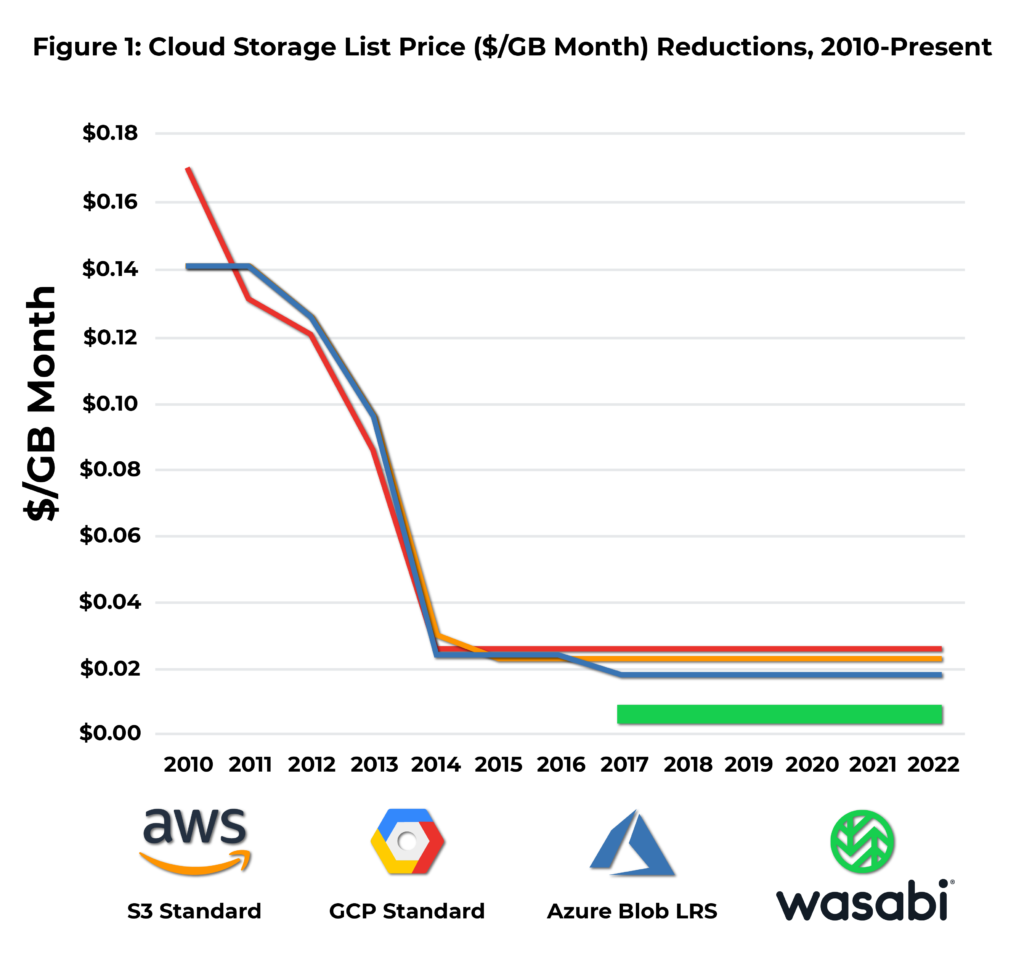

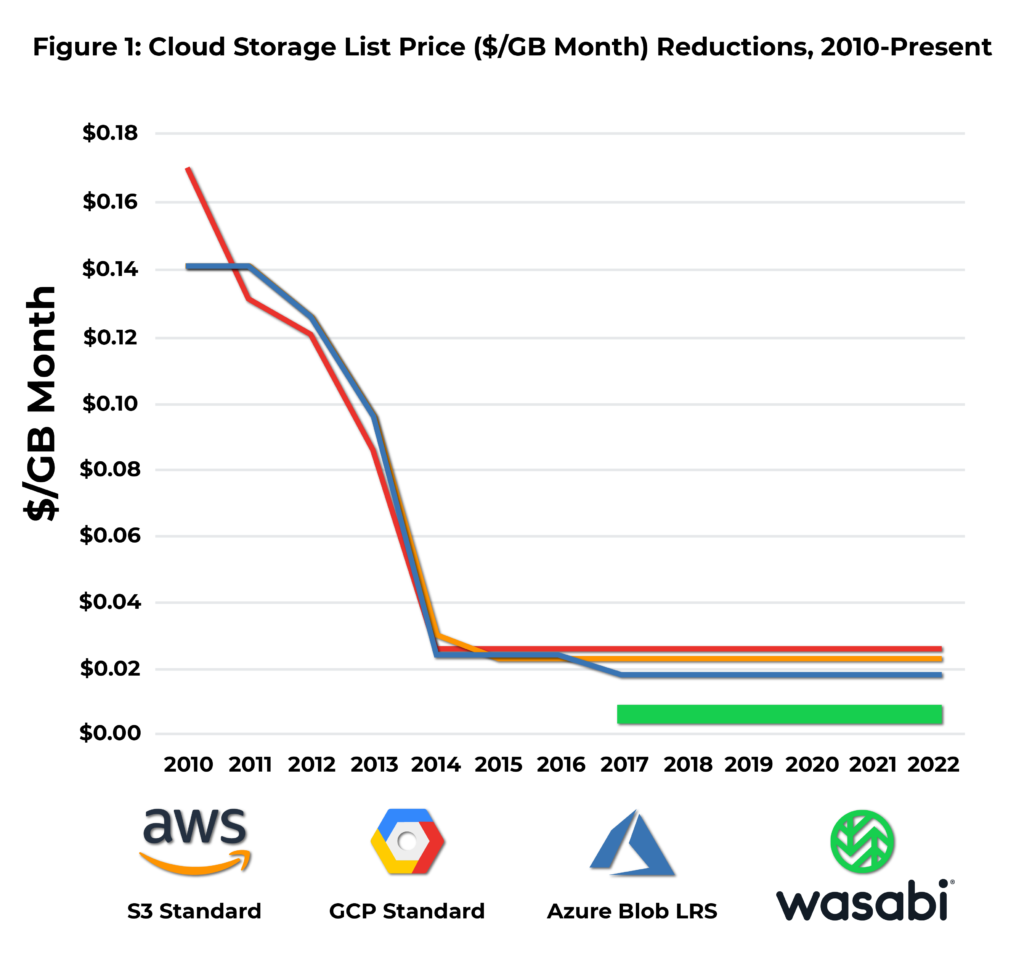

Cloud storage list-price stagnation can be seen across all major providers. The price history of AWS S3 Standard, GCP Standard, and Azure Blob is a good illustration of list-price reduction and subsequent stagnation over the past five years (see Figure 1). The simple fact is that $/GB rates for cloud storage have stopped trending down, and there have been no price reductions among leading providers since 2017. Between 2018-2022, instead of list-price reductions, many providers have introduced additional, lower-cost storage tiers (e.g., “cold” or “archive” tiers) as a way to help customers achieve ongoing cost reductions. But these new tiers require adoption, transfer of data, and new data lifecycle and management policies to realize these cost reductions – indeed a more complex and involved process compared to the instant gratification of a price reduction for existing service.

Figure 1: Cloud Storage List Price ($/GB Month) Reductions, 2010-Present

Source: Public pricing information

Note: Pricing rates for each year are based on publicly advertised list price at the end of the calendar year or the closest month with pricing history publicly available

Some quick calculations based on this price history:

- Between 2010 and 2015, AWS reduced the price of S3 Standard by 84%

- Between 2010 and 2017, Azure reduced the price of Blob LRS by 87%

- Between 2010 and 2014, GCP reduced the price of Standard storage by 85%

Cloud storage fee inflation is a relatively new trend but a topic that is increasingly observed across many cloud infrastructure services. We’re in largely uncharted territory here, but increases in infrastructure service pricing coincide with deteriorating macroeconomic conditions and recessionary threats, causing inflation across almost all sectors of the global economy. In addition to these threats, rising energy costs and protracted semiconductor supply chain challenges are two variables that have the potential to negatively impact the cloud IaaS market in particular. We don’t entirely know how these variables will continue to impact cloud storage pricing. Still, Google’s announcement of price increases for storage operations, multi-region egress, and object replication certainly goes against the established norm.

In the wake of list-price stagnation, it makes sense that we would see inflationary pressure begin to affect the underlying fee structures of leading providers first. Fee structures have not declined as much over time compared to storage list prices. Let’s use egress as an example. While the list price of storage has declined 80%+ for all three major providers, egress fees have only declined between 20-40%, depending on the provider. Since fees like egress have been more resistant to price reductions over time, it makes sense that providers would begin to introduce price increases for specific fees rather than increasing the list price of storage overall.

What does it all mean?

Many organizations rely on public cloud infrastructure services providers to help them “do more with less” and meet organizational requirements to store and analyze growing volumes of data with IT budgets that aren’t necessarily growing at the same rate. Increasingly expensive fee structures run contrary to this expectation. As a result of this changing market dynamic, we expect organizations to heavily scrutinize the impact and risk of potential pricing increases from their cloud storage provider – with the understanding that price increases are now a realistic possibility.

What’s Different About Wasabi:

As you navigate the changing economic landscape of cloud services and seek to manage infrastructure requirements amid growing budgetary risk and uncertainty, Wasabi should be viewed as a trusted partner in this process. Wasabi’s straightforward pricing structure eliminates the majority of cloud storage fees and helps users maintain consistency in a market that is growing in complexity. Finally, Wasabi’s commitment to delivering low-cost, performant, secure storage services should give users confidence that their experience with Wasabi will remain consistent over the long term as we continue to drive platform improvements.

The details: Wasabi’s pay-go storage rate is $0.0059/GB per month in North America and Europe and $0.0069/GB per month in APAC. Pay-go pricing does not vary within geo-regional locations (e.g., US-West is the same price as US-East). And Wasabi does not charge additional fees for data operations, API calls, or replication. Wasabi also allows users to take advantage of its free egress policy.

the bucket

On March 14, Google Cloud announced changes to its infrastructure services. These changes go into effect on October 1st, and several of the most significant pricing changes impact Google’s storage portfolio. GCP customers are undoubtedly aware of the change and have adjusted their cloud storage usage and budgets accordingly. You can see the complete list of pricing changes here.

Google’s pricing announcement is significant because it illustrates a larger shift in the cloud storage industry, characterized by list-price stagnation and fee inflation. Let’s explore these concepts in a little more detail:

Cloud storage list-price stagnation can be seen across all major providers. The price history of AWS S3 Standard, GCP Standard, and Azure Blob is a good illustration of list-price reduction and subsequent stagnation over the past five years (see Figure 1). The simple fact is that $/GB rates for cloud storage have stopped trending down, and there have been no price reductions among leading providers since 2017. Between 2018-2022, instead of list-price reductions, many providers have introduced additional, lower-cost storage tiers (e.g., “cold” or “archive” tiers) as a way to help customers achieve ongoing cost reductions. But these new tiers require adoption, transfer of data, and new data lifecycle and management policies to realize these cost reductions – indeed a more complex and involved process compared to the instant gratification of a price reduction for existing service.

Figure 1: Cloud Storage List Price ($/GB Month) Reductions, 2010-Present

Source: Public pricing information

Note: Pricing rates for each year are based on publicly advertised list price at the end of the calendar year or the closest month with pricing history publicly available

Some quick calculations based on this price history:

- Between 2010 and 2015, AWS reduced the price of S3 Standard by 84%

- Between 2010 and 2017, Azure reduced the price of Blob LRS by 87%

- Between 2010 and 2014, GCP reduced the price of Standard storage by 85%

Cloud storage fee inflation is a relatively new trend but a topic that is increasingly observed across many cloud infrastructure services. We’re in largely uncharted territory here, but increases in infrastructure service pricing coincide with deteriorating macroeconomic conditions and recessionary threats, causing inflation across almost all sectors of the global economy. In addition to these threats, rising energy costs and protracted semiconductor supply chain challenges are two variables that have the potential to negatively impact the cloud IaaS market in particular. We don’t entirely know how these variables will continue to impact cloud storage pricing. Still, Google’s announcement of price increases for storage operations, multi-region egress, and object replication certainly goes against the established norm.

In the wake of list-price stagnation, it makes sense that we would see inflationary pressure begin to affect the underlying fee structures of leading providers first. Fee structures have not declined as much over time compared to storage list prices. Let’s use egress as an example. While the list price of storage has declined 80%+ for all three major providers, egress fees have only declined between 20-40%, depending on the provider. Since fees like egress have been more resistant to price reductions over time, it makes sense that providers would begin to introduce price increases for specific fees rather than increasing the list price of storage overall.

What does it all mean?

Many organizations rely on public cloud infrastructure services providers to help them “do more with less” and meet organizational requirements to store and analyze growing volumes of data with IT budgets that aren’t necessarily growing at the same rate. Increasingly expensive fee structures run contrary to this expectation. As a result of this changing market dynamic, we expect organizations to heavily scrutinize the impact and risk of potential pricing increases from their cloud storage provider – with the understanding that price increases are now a realistic possibility.

What’s Different About Wasabi:

As you navigate the changing economic landscape of cloud services and seek to manage infrastructure requirements amid growing budgetary risk and uncertainty, Wasabi should be viewed as a trusted partner in this process. Wasabi’s straightforward pricing structure eliminates the majority of cloud storage fees and helps users maintain consistency in a market that is growing in complexity. Finally, Wasabi’s commitment to delivering low-cost, performant, secure storage services should give users confidence that their experience with Wasabi will remain consistent over the long term as we continue to drive platform improvements.

The details: Wasabi’s pay-go storage rate is $0.0059/GB per month in North America and Europe and $0.0069/GB per month in APAC. Pay-go pricing does not vary within geo-regional locations (e.g., US-West is the same price as US-East). And Wasabi does not charge additional fees for data operations, API calls, or replication. Wasabi also allows users to take advantage of its free egress policy.

featured articles

THE CHANNEL TECH PARTNERS

January 24, 2024

Announcing the Winners of our 2023 Partner Awards

Announcing the Winners of our 2023 Partner Awards

WASABI TECHNOLOGY

January 23, 2024

A Letter from the CEO: On Wasabi’s Acquisition of C...

A Letter from the CEO: On Wasabi’s Acquisition of ...

VIDEO SURVEILLANCE

January 25, 2024

Navigating the Future: The Evolution of Security In...

Navigating the Future: The Evolution of Security I...

DATA MANAGEMENT CASE STUDY

January 22, 2024

Australian MSP Office Solutions IT Migrates Service...

Australian MSP Office Solutions IT Migrates Servic...

COMPLIANCE CASE STUDY

January 17, 2024